What Is Depreciation Recapture?

The term “depreciation recapture” refers to the amount of gain that is treated as ordinary income upon the sale or other disposition of property. Gain that is treated as capital gain is not depreciation recapture. If you do your own taxes and you never heard of “depreciation recapture” – it’s time to get an accountant. If you already have an accountant and they never discussed “depreciation recapture” with you – you need a new accountant! Either way, this post will walk you through some of the basics.

A Simple Example

Let’s begin with an example. You bought a rental property in 2007 for $200K. True, this was right before the “great financial crisis” and your property is worth less, but that is besides the point (for the moment). In 2014, you manage to sell it for $175K. If life was simple, you could get away with the following calculation: your loss is the $175K sales prices less the $200K purchase price, or $25K. You held the property more than a year, therefore it’s “long-term.” Done right? Not so fast my friend.

Unfortunately, it is not so simple, and instead of having a loss, you actually have a gain. How come? Because of depreciation. Every year since 2007 you were depreciating the property, correct? Well, that depreciation lowered your tax bill and you received a benefit because of it. But if you think you got a free ride from the government, think again. What you were saving on depreciation comes back to haunt you now when you sell the property. So (for simplicity) let’s assume that each year you received $7,272 in depreciation. This is approximately $51K of depreciation over the 7 years. Thus, the building wasn’t really wrth $200K for tax purposes, but only $149K. SInce you sold the building for $175K, you really had a $26K gain!

It gets worse. Under “normal” circumstances, the tax rate on most net capital gain is no higher than 15%. Some may be taxed at 0% if you are in the 10% or 15% ordinary income tax brackets. However, a 20% rate on net capital gain applies in tax years 2013 and later to the extent that a taxpayer’s taxable income exceeds the thresholds. Furthermore, there are a few other exceptions where capital gains may be taxed at rates greater than 15%:

- The taxable part of a gain from selling section 1202 qualified small business stock is taxed at a maximum 28% rate.

- Net capital gains from selling collectibles (like coins or art) are taxed at a maximum 28% rate.

- The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate.

In case you missed it, it’s that last bullet that refers to depreciation recapture. And yes, it’s taxed at 25% versus 15%!

The actual calculations can get quite involved depending on the amount of the gain, the amount of depreciation taken and the tax bracket you fall into. But once again for simplicity (and illustration), since you took $51K of depreciation, the entire $26K gain would be considered depreciation recapture and you could pay $9K in taxes related to it.

If you’re tired at this point, we don’t blame you. Albert Einstein is quoted as saying that the hardest thing in the world to understand is the income tax. As seen above, the IRS does a pretty good job proving his point!

Tax Planning Tips for Depreciation Recapture

So just how can you get out of depreciation recapture? The short answers is you can’t, but there are things that can help or delay it’s payment. For example, when a rental property is sold, any passive activity losses that were not deductible in previous years become deductible in full. This can help offset the tax bite of the depreciation recapture tax.

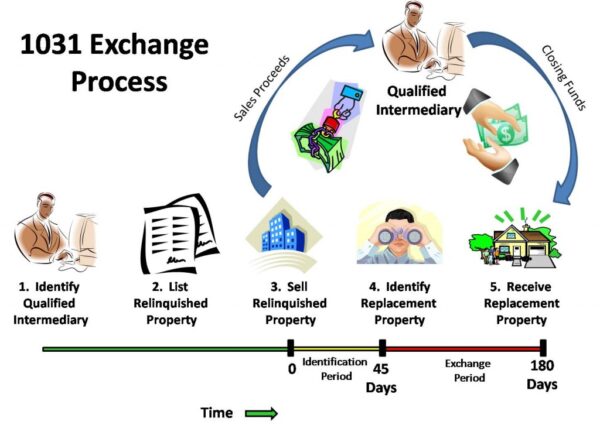

By the way, you’ve heard of 1031 exchanges, haven’t you? Next time, you may want to think about using one before you sell your property. When a rental property is sold as part of a like-kind exchange, both capital gains and depreciation recapture taxes can be deferred until the “new” property is disposed of.

There’s one tax strategy, however, that will not help. Since depreciation is recaptured when the asset is sold, it is reasonable that some people would think that by avoiding claiming depreciation they can also avoid the recapture tax. This strategy does not work, because the tax law requires depreciation recapture to be calculated on depreciation that was “allowed or allowable” (Internal Revenue Code section 1250(b)(3)).