Is Your Tax Relief Company Reputable?

For those who are unaware, the tax relief industry is a highly fragmented one. Companies offering services to the public tend to be either one of the “Big Nationals” or smaller local practitioners. Well, in recent years, there have been some Big Nationals in the spotlight for reportedly violating consumer protection laws (e.g. TaxMasters, JK Harris and “Tax Lady” Roni Deutch). One other such company was American Tax Relief.

The FTC originally filed charges against American Tax Relief in September 2010. These charges included that the defendants falsely claimed they already had significantly reduced the tax debts of thousands of people and falsely told individual consumers they qualified for tax relief programs that would significantly reduce their tax debts. In the end, these clients paid in excess of $100 million for services and received minimal, if any, resolution to their tax problems.

Well, as a partial consolidation, the Federal Trade Commission said it is mailing more than $16 million in refund checks to 18,571 consumers who had paid money to American Tax Relief. All in all, these consumers will receive about 16% of the money the lost. The sad part is that many are still in hot water with the IRS; simply because they picked the wrong company to represent them before the IRS.

So how do you know if the company you are engaging to handle your case is reputable? Unfortunately, with loose regulation of the tax representation industry, you don’t. But here’s where we can help! If you visit our IRS Debt Representation page, you can receive our FREE whitepaper 5 Questions To Ask Any Tax Resolution Firm BEFORE Paying Them A Dime. On top of that, we’d also be happy to discuss your situation absolutely free of charge. Simply follow the instructions on the page and before you know it, you’ll have a professional representative on your side to help you stop your IRS worries for good!

For more details on the American Tax Relief case, check out Accounting Today’s article: Tax Relief Company Agrees to Turn over $16 Million to Bilked Consumers.

The “Real” Power of Gas Buddy

This App WILL save you money!

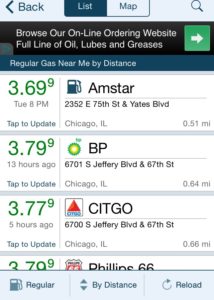

When it comes to saving money, we’re always looking for new and insightful things to share with our clients. Bring in Gas Buddy; a website and App for your phone that tells you the gas prices at a specific station, in REAL TIME. So what’s so good/powerful about this tool? Keep reading.

Recently you’ve probably heard the term “big data” being tossed around a lot. It’s a popular term used to describe the exponential growth and availability of data, both structured and unstructured. This is important to both businesses and individuals, as individuals in Finance already know, more data “may” lead to more accurate analyses.

Big data defined

As far back as 2001, industry analyst Doug Laney (currently with Gartner) articulated the now mainstream definition of big data as the three Vs: volume, velocity and variety. Below is a list of what caused changes in each over the past decade or so.

Volume. Many factors contributed to the increase in data volume. Transaction-based data was stored in increasing amounts through the years. Unstructured data began streaming more frequently via social media. Increasing amounts of sensor and machine-to-machine data began to be collected. All the above resulted in increased data volume.

Velocity. Data is streaming in at unprecedented speed and must be dealt with in a timely manner. RFID tags, sensors and smart metering are driving the need to deal with torrents of data in near-real time. Reacting quickly enough to deal with data velocity has become a challenge for most organizations.

Variety. Data today comes in all types of formats. Structured numeric data in traditional databases. Information created from line-of-business applications. Unstructured text documents, email, video, audio, stock ticker data and financial transactions all floating around the web (can someone say cat video). Managing, merging and governing different varieties of data is something many organizations still grapple with.

Gas Buddy’s Part

So where Gas Buddy fits into this equation is that it allows for two things to happen in the big data realm. Firstly, it allows users to gather data (i.e. gas prices) so that it may be housed in a centralized place. Secondly, it provides visibility to that data where in the past it would have been cost ineffective for consumers to gather it on their own (e.g. driving around to gas stations to see which one has the cheapest price). The outcome of these two things is where the real power of Gas Buddy lies:

The Knowledge To Make Informed Decisions

Our CEO Jared lives about 7 miles from the Indiana boarder. Anyone in the Chicago area knows that there is a significant difference in prices between Illinois and Indiana. Thus, for years Jared would simply go to Indiana to purchase gas “knowing” that he was saving money. How much money? That’s where Gas Buddy helped to clarify some things. Let’s take a look at a hypothetical example. We’ll try to keep it simple so as to not use too many numbers.

Let’s say that Jared has to fill up his car which holds 10 gallons of gas. He knows that the station closest to his house is charging $3.79 a gallon. So if he filled up there he would spend $37.90 for a tank of gas. Now he goes to Indiana enough to know that the prices across the border are about $0.30 cheaper per gallon. So if he buys gas for $3.49 he would spend $34.90. Thus his tank of gas cost him $3.00 less. But the real savings isn’t $3.00 because he had to drive 20 miles round trip to get the gas. Let’s say he burned 2/3 a gallon of gas to make the trip. Ignoring the cost of the gas in the tank and what he purchased, if we assume he spent $2.33 (2/3 of $3.49) on gas driving to get the cheaper gas, then his savings would “really” be $0.77 ($3.00 tank savings less the $2.33 spent to get it).

Not much savings for all that driving right? Well, with Gas Buddy now Jared has visibility 1) into the prices being charged by all the stations he wants to know about and 2) when they are changing (which is key).

Now Jared doesn’t have to assume that he can save $0.30 when he goes to Indiana. He can now compare the cheapest stations where he is currently located (you can get prices nearest you with Gas Buddy) to ALL the cheapest stations. Thus, it may turn out that the station near his house that charges $3.79 is simply overcharging for the area. There may be a station that is 2 miles from his house that only charges $3.59. This narrows the Indiana gap to only $0.10 ($3.59 vs. $3.49). This would make it unprofitable for him to go to Indiana to get gas as the savings wouldn’t outweigh the cost of getting the gas.

He can also see that the station out in the burbs, where he is working on a client engagement, is charging $3.45 for a gallon of petro. This is $0.04 cheaper than Indiana! The result? Jared may just wait to get his gas when he goes to the client site in the morning and get it for cheaper than his beloved Indiana gas.

So there you have it. The lesson to be learned from this? That whole “knowledge is power” adage. The more information that you have at your disposal, the more informed you are when making decisions. The more informed your decisions, the greater the probability of a more bountiful or fruitful outcome.

Until next time…

FATCA Transitionary Period Announced

The provisions commonly known as the Foreign Account Tax Compliance Act (FATCA) became law in March of 2010. FATCA targets tax non-compliance by U. S. taxpayers and focuses on the reporting of individuals and financial institutions. However, to aid in compliance with the act, the IRS underwent several “phases” of enforcement (so to speak). Well, the IRS has announced that they will treat the remainder of 2014 and all of 2015 as a “transition period” for financial institutions to comply with FATCA requirements.

This transition period will not postpone the implementation of any parts of the law, including the 30% withholding rate on transactions by non-compliant financial institutions. Rather, the IRS will gauge whether or not financial institutions are moving towards compliance in a good faith manner. If they are, then those financial institutions will not be penalized.

The IRS is still in the process of developing all of the new forms that will be required as part of the FATCA compliance process (the W-8 series). The IRS still expects foreign financial institutions to make progress towards compliance for the next 18 months, but will be lenient towards enforcement. The IRS has also warned that companies that are normally required to withhold funds for various purposes must continue to do so. The FATCA transition will not be an excuse to avoid normal backup withholding, for example.

More and more foreign governments are signing information sharing agreements with the IRS, as well. Even more governments have negotiated agreements that have yet to be signed.

On a personal level, it is becoming more and more difficult to avoid the long arm of the IRS. If you maintain accounts overseas, check to make sure that your foreign financial institution is either compliant, or working towards compliance, with FATCA. This will help you avoid the 30% withholding on any transactions between your foreign and U. S. financial institutions.

If you have questions regarding how FATCA will impact you, have questions about your FBAR filing, or any other matters pertaining to your overseas financial interests, please be sure to give us a call at 773-239-8850 to discuss these matters.

Tax Issues for Self-Employed Individuals

Many self-employed individuals are considered “sole proprietors” or “independent contractors” for legal and tax purposes. This is true regardless of whether you are turning a hobby into a business, selling an indispensable widget or providing services to others. As a self-employed person, you report your business revenue results on your personal income tax return. The following are a few guidelines and issues you should keep in mind when pursuing your entrepreneurial spirit.

Schedule C – Form 1040

As a self-employed person, you are required to report your business profits or losses on Schedule C of Form 1040. The income earned through your business is taxable to you as an individual. This is true even if you do not withdraw any money from the business. While you are required to report your gross revenues, you are also allowed to deduct business expenses incurred in generating that revenue. If your business efforts result in a loss, the loss will generally be deductible against your total income from all sources, subject to special rules relating to whether your business is considered a hobby and whether you have anything “at risk.” If it generates a profit, then you will have to pay taxes on it.

Home-Based Business

Many self-employed individuals work out of their home and are entitled to deduct a percentage of certain home costs that are applicable to the portion of the home that is used as your office. This can include payments for utilities, telephone services, etc. You may also be eligible to claim these deductions if you perform administrative tasks from your home or store inventory there. If you work out of your home and have an additional office at another location, you also may be able to convert your commuting expenses between the two locations into deductible transportation expenses. Since most self-employed individuals find themselves working more than the traditional 40-hour week, there are a significant number of advantageous deductions that can be claimed. Unfortunately, we find that most self-employed individuals miss these deductions because they are unaware of them.

The Bad News – Self-Employment Taxes

A negative aspect to being self-employed is the self-employment tax. All salaried individuals are subject to automatic deductions from their paycheck including FICA, etc. In that many self-employed individuals often do not run a formal payroll for themselves, the government must recapture these taxes through the self-employment tax. Simply put, you are required to pay self-employment taxes at a rate of 15.3% on your net earnings, up to an annual income cap. Beyond the annual cap, the rate is reduced to just the Medicare tax rate of 2.9%.

In an interesting twist that reveals the confusing nature of the tax code, you are allowed a partial deduction for the self-employment tax. Simply put, you are allowed to deduct one-half of your self-employment taxes from your gross income. For example, if you have to pay $10,000 in self-employment taxes, you are allowed a deduction on your 1040 return of $5,000. Many self-employed individuals miss this deduction and pay more money to taxes than needed.

No Withholding Tax

Unlike a salaried employee sitting in a cubicle, the taxes above are not withheld from your paycheck. While this sounds great, you are required to make quarterly estimated tax payments. If you fail to make the payments, you are subject to a penalty, but the penalty is not the biggest concern. A potentially dangerous pitfall of being self-employed is failing to pay quarterly estimated taxes AND then getting caught at the end of the year without sufficient funds to pay your taxes. The IRS is not going to be happy if you fail to pay your taxes and you will suffer the consequences in the form of penalties and interest. Making sure you pay quarterly estimated taxes helps avoid this situation and it is highly recommended that you follow this course of action. If you have encountered this situation for yourself, be sure to contact us immediately to help you remedy this particular circumstance.

Record Keeping

You must maintain complete records of all business income and expenses. Simply put, document everything. Create a filing system for each month and file every receipt, etc. All business travel expenses must be documented, including auto mileage you incur when performing business tasks. Office supply stores sell business mileage books that you can keep in your car and use whenever you travel. There are even some apps for your phone that will allow you to push a button at the beginning and end of your trip and it will calculate the mileage for you. If you have any doubt about documenting something, just do it!

As a self-employed individual, your focus and time is spent on making your business successful. Your focus is not on the complexities of the tax code and how to limit the amount of taxes you owe. If any of the information in this article is new to you, then it is highly likely you have paid far more in taxes than required.

Employment Tax Penalties

When you hire employees to work in your business, you’ll quickly learn one of the unfortunate consequences; payroll taxes. These taxes not only include the amounts your employee asks you to withhold on their behalf, but your fair share of social security, Medicare and unemployment tax. If you make the payments on time, all will be well in the universe. Fail to pay timely, or not at all, expect the IRS will rain all over your parade.

If you have employees, you absolutely must deduct and withhold various taxes from their paychecks. Since you are deducting money from the employee’s paycheck, you are handling their funds. In fact, you are handling these funds in “trust,” meaning that they really don’t belong to you, they belong to the IRS. This fact is very important to the IRS and it places great emphasis on any failure to deposit employment taxes. We often tell clients, the IRS will take a few months/years to “come after” a taxpayer for late payment of income taxes. However, they will contact you and take “aggressive” collection action much sooner if the taxes in question are payroll related.

If you fail to pay employment taxes, you may be personally subjected to a 100% penalty. Yes, you read that right, 100%. Known as the “trust fund recovery penalty,” this penalty can be assessed against the person responsible for paying the taxes, not the entity. The person can be the owner, corporate officer or other “responsible person.” In short, a business entity is not going to protect you from the wrath of the IRS if you didn’t deposit your payroll taxes. They will hold the “responsible person” 100% accountable for paying the taxes; even if the business is closed!

Cash flow crunches are an inevitable event for practically every business. So, what happens if you make a late payment for employment taxes? Unless you can show reasonable cause for the delay, the IRS is going to penalize you.

Late payment penalties range in amount depending on the delay. If the delay is less than six days, the penalty is 2%. Delay for six to 15 days and you are looking at 5%. More than 15 days in delay is going to push the penalty to 15%. If you delay this long, the IRS will begin peppering you with penalty notices telling you where you stand.

The best solution to dealing with this is to get the money to the IRS as quickly as possible. If the amounts involved were significant and resulted in large penalties, you may want to consult with a tax professional to see if the penalties can be abated (i.e. forgiven). If you can’t pay the amounts owed, then you will definitely want to consult with a tax professional to review your options (i.e. installment agreement, offer in compromise, currently-not-collectible, etc.) and negotiate a “formal” resolution with the IRS. Any of the above are matters that we can assist you with, so feel free to shoot as email or call us via the information listed below.

In closing, whatever you do, make sure you deposit employment taxes with the IRS in a timely fashion. Take a moment to think about the worst thing you have ever heard done by the IRS. If you fail to pay employment taxes, the actions taken by the IRS will be ten times worse and you will be the one telling the horror story!