Can You Stop The IRS From Garnishing Your Wages?

Sometimes, no matter how careful you are about filing your taxes and paying what you owe, the time may come when you have a bill that you can’t pay. Like all creditors, the Internal Revenue Service will try to collect what you owe using several different means. One of those methods is via a wage garnishment.

Employers are prohibited from letting you go because of a wage garnishment issue, a protection extended under the Consumer Credit Protection Act. However, you get only one “get out of garnishment jail free card.” A second garnishment isn’t protected by Uncle Sam, and an employer who views an employee with a second garnishment as a mark on his or her character has every right to fire them.

What is Wage Garnishment?

Simply put, a wage garnishment is when the IRS locates a debtor’s employer and takes their wages during each pay period until the debt is paid in full. A wage garnishment can be used to collect a debt that you owe due to a late filing. It can also be used when you file your return correctly but do not pay the full balance of your debt.

A wage garnishment is most commonly levied by the IRS or via a court ruling. To implement the garnishment, the IRS obtains a judgment and sends it to the debtor’s employer. The employer is then required to withhold a certain amount of the individual’s paycheck each pay period and send it to the IRS until the debt has been fully paid. Depending on state laws, a garnishment may take anywhere from 30 percent to 70 percent of your paycheck to cover your unpaid debts.

Furthermore, the IRS is particularly tough; it can garnish both your income and, if you’re retired and collecting government benefits, can take your Social Security checks, too. The levy usually isn’t lifted until the debt is paid off in full. However, you do have some options, though, as outlined by the IRS.

Stopping A Wage Garnishment

Pay off the debt in full. Once that’s done, the garnishment is automatically lifted. This is the quickest and least painful way to get the IRS off your back.

Offer a lower bulk payment as compromise. If you can negotiate a “payoff” sum with the IRS, you can also avoid a wage garnishment. This one’s tricky though, and you’re better off checking in with a tax professional before you climb into the ring with the IRS.

Ask the IRS for a payment plan. Uncle Sam may be willing to negotiate regular monthly payments to erase your debts and avoid the need to garnish your wages at all. However, just note that this is typically only granted if you demonstrate that the levy is causing you financial hardship. Thus, if you are receiving notices of tax debt owed, but have yet to have your wages garnished, it’s best to try and set up a payment plan BEFORE this IRS begins garnishments. Once the garnishment is in place, the IRS has little impetus (other than the hardship situation) to revert to a payment plan if it’s collecting money from you.

Quit your job and dodge the IRS for a while. If you quit your job, it will probably take the IRS a few months to track you down at your new job. They won’t like it, but at least your wages won’t be garnished in your new job (for the short term, anyway). That might buy you some time to come up with the money to settle your debt.

File for bankruptcy. This option should not be used lightly, but if it’s “last resort” time, bankruptcy can at least help you avoid wage garnishment, or have it released if the garnishment is already in place.

Don’t create a garnishment to begin with. The best way to avoid a wage garnishment may be old-fashioned, but it works all the time. Pay your bills on time, save some money for emergencies and spend less than you earn. Do that and neither your employer nor the IRS will be dogging you about wage garnishments ever again.

Milestones – Our 100th Post

Funny how time flies. Two years ago we were just a few weeks away from opening up the doors to our Beverly retail office. In this, our 100th post, we thought it would be appropriate to reflect a little.

When we created our blog, we set one simple goal for it; create one post per week with content we believed would be relevant to our customers as well as general taxpayers. During that time we’ve gone through two tax seasons, refreshed our website, increased our client base as well as a host of other things. The point you may ask? Well, none of this would be possible without milestones.

Milestones serve to inform us of how far we are in our journey and how much further we have to go. In the short two years of opening our office, we’ve come quite a way from our beginnings. Yet, we still have a long way to go to our self prescribed destination.

With that said, as we prepare to enter into a new year (which many will mark with New Year’s Resolutions), we urge all of you to set goals for yourself along with milestones. That way, when you’re questioning whether you should continue on your journey (or if you have the strength to) you’ll have a pretty clear answer to help you in your decision.

Now back to getting ready for our 3rd tax season…

Related articles

- Milestones (phindelamuses.wordpress.com)

My View: The Two Biggest Keys To Success

When you advise aspiring and fledgling business owners, one question that routinely comes up is what it takes to be successful. While it takes many ingredients to achieve success, there are two that are key in my opinion.

Persistency

Back in High School I tried out and made the football team. In reality it wasn’t that hard as they pretty much took anyone who tried out. But the real challenge was getting to play. Most of the playing time (a.k.a. “tick”) was given to starters and second string players. Me? Oh, I was just a guy who was on the team; by most standards I was just your typical benchwarmer. But just like everyone else, I earned my “letter” for each year I was on the team. And just like everyone else, I sported my letters on my letterman’s jacket. To the girl at the bus stop, I looked just like all the other “jocks” when we got off the bus at her stop!

The point of this story is what? Quite simply, persistency pays off. I could/should have quit numerous times during the years I played football. The total amount of tick I got was probably the equivalent of a first half, but was spread across three years. Yet I didn’t give up. I never succumbed to the pressure to stop going to two-a-days. I never let the ridicule of “star” players deter me from marching on. But more importantly, I never let myself disappoint the one person who really mattered; me.

If you want to be successful, you have to sometimes have the fight of a dog in you. When everything is pointing to stopping, you have to tell yourself that success may be just around the corner. And if you can be persistent? You might just wind up with a successful business like all those other entrepreneurs who started their business just like you did; one day at a time.

Consistency

Some of the greatest people have achieved their success not because of special talents or intellect, but because they consistently plod along. Whatever goals you’re trying to reach; they aren’t just going to happen. You have to actually/consistently be working on them.

Here is a case in point. When you are wooing someone, you go through the effort of being consistent. You will routinely call them, see them, take them on dates, tell them they are special, compliment them, etc. But what happens once you’ve won their heart? Those consistent things start to fade by the wayside. Why? Primarily because you achieved you goal; getting them to become your boyfriend, girlfriend or spouse!

The moral of the story is that you achieve your goals by consistently doing the necessary work. If you walk a few steps each and every day of the year, after a year you will have walked several miles.

20 Things I’m Thankful For

Around this time of year, I often find myself reflecting on life. What has happened this past year, where I want to go next year and how I fit into the world. This often happens when I am on the bike (as all you have time to do is ride and think), but this year I feel compelled to share what swirls around this old noggin with you.

If you’ve known me for any amount of time, you know that I “try” to see the good in things. Despite reality, I try to “assume positive intent” of others and their actions. I attempt to take nothing for granted and show appreciation for all that I have in life. While I didn’t grow up in the lap of luxury, our family didn’t struggle either. So with that, as I sit here on Thanksgiving, I wanted to share just a small fraction of the things I am thankful for.

Life People take life for granted; the frailty, the certainty that it will one day end, the marvel of breathing without conscious thought. To that end, life is an extremely precious gift that can be taken away before one’s had the opportunity to fully experience it. With that, I am grateful for each day that I have walked on this Earth.

My Immediate Family The world can be a cruel place. Sometimes, you feel as if you are standing alone and no one gives one iota about you. But then there is your family. To my mom, dad and sister, I am so fortunate to have had them (and still do) in my life.

My Extended Family When you marry your spouse, you marry into their family. If you’re lucky, it’s like gaining a whole new set of friends. To all of those new friends (okay, not so new as I’ve been married 7 years now), I am fortunate to call you part of my family.

My Wife I could write a book about this woman. When you’re searching for a person to share your hopes, passions, dreams and life with, you can only hope that you’ll meet a person who meets a fraction of what you are looking for. I was lucky enough to find someone who vastly exceeded them. Aaronita is my rock and quite possibly the strongest woman I know besides my mother. To that end, I wouldn’t be able to do or attempt half of what I do without her support. So to you babe, I am extremely thankful that I had the opportunity to meet you and for me to be a part of your life.

My Daughter She is my love and my life was forever changed on that August 15, 2009. She makes me strive to be a better person so that I can be the father that she deserves. Kiddo, Dada loves you!

Love The simple act of being kind to a fellow human being is sometimes all it takes to help that person make it through a difficult situation. I am fortunate for all the love that people have shared with me.

My Upbringing I grew up in a loving household with two parents that cared and a sister with whom I could share my grief with. Not everyone has/had this in their life. I’m thankful that I did.

My Education I didn’t go to the fanciest schools. My parents did the best for me with what they had. Each one of those schools I attended taught me something; whether it was book knowledge or life lessons. Whether it was St. Thomas the Apostle, De La Salle, Truman State University or DePaul University, I value all the opportunity I was given.

Opportunity What is the difference between someone who lives in Beverly Hills, the barrio, the ghetto, and Kenya? Nothing. But what determines how their life unfolds is intrinsically tied to the opportunities they are presented with. Not everyone is dealt the same deck of cards. I am happy for the one I got and the hand I’ve been able to play.

My Corporate Career I’ve worked with lots of people in various companies over the years. Each one of them taught me something which made me into what I am currently. I’m fortunate for all that I was able to experience.

My Company It evokes a certain feeling of pride every time I see our company’s name. To know that it’s something that I helped create, something that serves a purpose bigger than myself, something that helps others in this world; that makes me feel proud and honored.

Our Clients Without their trust, confidence and patronage, we wouldn’t have a company at all. So to all of you, thank you from the bottom of my heart.

Nature This world is a beautiful place filled with wonderful people, places, animals and other things. I try to do my part to not destroy it and preserve it so it’s around for Pilar to enjoy. But that aside, I am lucky to have seen some of the many sights that our amazing planet has to offer. I can only hope that I get to see/enjoy much more in the future.

Health Things could always be worse. Be grateful for what you have because one day, health will fail us all.

Friends I don’t keep a large circle of friends; just a few close ones. Blame the loner in this Aquarius! But I am extremely grateful for everyone that I have in my life, no matter how large or small the extent.

Support It makes me smile when people say that they are “self made” or that they “did it all on their own.” While that is somewhat true, we’ve all received an extended hand at one point or another. To anyone who has ever helped me (like the good Samaritan who called the ambulance when I crashed and knocked myself out on the bike path), I am appreciative of you.

The United States Sometimes this country is like the drunk Uncle in your family. You love them, but sometimes they drive you crazy. In the end, this county is still one where one can attempt to achieve their dreams and live a life that others in this world cannot. Thus, I am thankful to call this place home.

God You don’t have to be religious to believe in a higher power; I’ll be the first to admit that I’m not overly religious. Yet I do believe that I’ve been blessed as all my “chuch folk” would say (no that is not a typo). God, Yahweh, Buddha, Muhammad, The Universe (or whatever you want to call it) and I have a relationship. I am thankful for that.

The Necessities I have a roof over my head, clothes on my back and food in my belly. Tyler Durden said it best with this statement: “Advertising has us chasing cars and clothes, working jobs we hate so we can buy s@&! we don’t need.” In the end, I am happy for what I have because it’s all that I really need (and then some).

To Be Employed In these trying times, people who have had their entire existence defined by where/who they work for are struggling to cope with extended periods of unemployment. To all of you, keep up the good fight and if opportunity doesn’t knock, build a door and then kick that joker in!

Understanding The 1031 Exchange

Most real estate investors have at least heard of the 1031 exchange, but very few have actually completed such a transaction. The 1031 exchange is a powerful tool to have in your creative real estate arsenal, as it allows you to dispose of one property and acquire another without paying capital gains tax on the property you are disposing of.

However, a 1031 exchange requires careful attention to the requirements, particularly as they relate to timing, in order to avoid potential ghoulish dealings with the IRS.

To start with, it is important to understand exactly what a 1031 exchange is. Named after the section of the Internal Revenue Code under which it resides, a 1031 exchange is the swap of one asset for another similar asset. In other words, in order to take advantage of this tax section, the type of property swapped must be of a similar “nature or character.” For example, livestock of different genders are not considered like-kind property.

Fortunately, this is not much of an issue with real estate, as the code allows for the exchange of any real property for any other real property. The property (generally) must be a business or investment asset, meaning the property generates revenue or helps in generating revenue. Typically, these properties will be warehouses, offices or rental homes. Primary residences and other property that do not generate regular income do not qualify, such as a second home or vacation home.

Properties located inside and outside the country cannot be exchanged for each other. Also, real property cannot be exchanged for personal property, such as a house for farm equipment. Lastly, personal residences are not eligible for like-kind exchanges; the property must have been an investment or business property to qualify.

One of the nicest features of the rule is that the properties do not have to be of similar “grade or quality.” In other words, it’s perfectly legitimate to exchange a house in much need of repairs for a property that is in pristine condition. The like-kind exchange is an ideal vehicle for trading up properties without paying capital gains taxes.

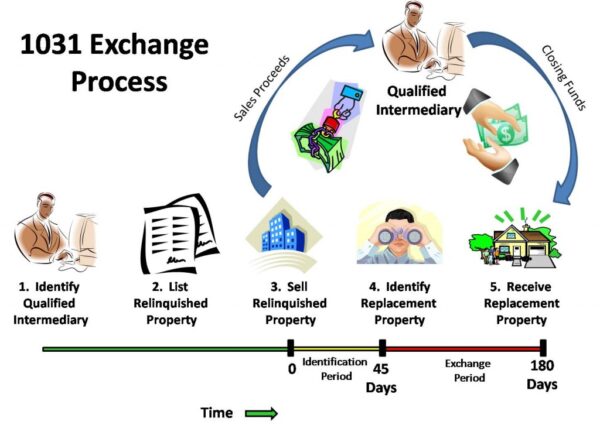

Timing is a key element to a successful 1031 exchange. In order to qualify for the capital gains deferral, the decision to treat a property sale as part of a 1031 exchange needs to be made before the closing date of the sale of that property. Then, the seller must identify the property to be acquired in the exchange within 45 days of the closing date of the sold property. The new property must then be acquired within 180 days of the date that the prior property was sold.

The 1031 Exchange Explained Visually

When it comes to identifying the replacement property, there are some interesting rules, and you can pick which rule you want to follow. The property needs to be of equal or greater value, but you can select multiple properties as potential properties to buy, subject to the following rules:

1. You can select up to three distinct properties as possible replacement properties for the exchange, regardless of their value, OR…

2. You can select any number of properties, as long as their total fair market value does not exceed double the value of the property you sold, OR…

3. You can select any number of potential properties to buy, as long as the fair market value of the property you eventually close on within the 180 day window is at least 95% of the value of the property you sold.

In order to protect the “integrity” of the like-kind exchange, the IRS requires that you use a qualified intermediary in order to complete the transaction and qualify for the capital gains exclusion. The qualified intermediary escrows the proceeds from the sale of the first property, and ensures that the funds are only used to acquire a like-kind property.

The qualified intermediary works with your title company, escrow company, or closing attorney to facilitate the transaction. The key element of this part of the transaction is to ensure that you never actually obtain receipt of the funds from the property sold, and there is no record of it passing through your own personal accounts.

Normally when an investment property is sold, you must recapture the sum total of the depreciation you have claimed on the property. In other words, your taxable capital gains include not only the actual appreciation in the property’s value, but also the amount that you deducted as depreciation over the time you owned.

A beautiful benefit of the 1031 exchange is that there is no depreciation recapture required. Instead, the accumulated depreciation in the old property affects your basis in the new property you are buying in the exchange.

Since the purpose of the like-kind exchange is to avoid paying capital gains tax on appreciation of properties, there is no benefit to using a 1031 exchange on a property on which you have a loss. By selling a property for a loss, a portion of that loss becomes deductible. The 1031 exchange rules do not recognize losses as an adjustment to the basis in the newly acquired property, so there is no benefit in using this vehicle for that purpose.

Our hope is that this article has provided you with enough information to make the decision of when to use the 1031 exchange rules to your benefit. As with all things, however, be sure to consult with a licensed tax professional for advice regarding your specific transaction, and remember that you must use a Qualified Intermediary in order to complete the transaction.

Are you are thinking of disposing of your property and have questions? Why not give us a call? We are here to help, and only a phone call away!

Related articles

- Keys Rules For Section 1031 Exchanges (harp-onthis.com)